Product research panels -

gen pop sample that qualify for just about any study but are still vetted for quality. A gen pop sample tends to include quotas representative of the population surveyed, so that you're still achieving varied points of view in terms of age, gender, region, and ethnicity.

Back to Table of Contents Building your own research panel While panel providers have many benefits, some companies may opt to build their own proprietary sample.

Below are a few key steps in building your own research panel: Determine your source Where do you want to gather your group of panelists from?

Is it from your own company's email list? Newsletter subscribers? Social media followers? A combination of all three? Figure out where these respondents are going to come from and then make sure that source is able to update as new consumers qualify those who make a first-time purchase, follow your brand, subscribe to your newsletter, etc.

If you don't have your own reliable sources of panelists, there are many third-party vendors that can help - such as affiliate networks, purchased lists, and more.

Gather key information Upon identifying your group of panelists, it's time to start gathering some key information about them so you can easily target the right consumers for future surveys.

Start broad, with just capturing a respondent's name, age, and email perhaps. Once you start to build up your panel with this basic information, you can begin to get more specific in terms of what those panelists do for an occupation, where they live, how much they earn a year, etc.

Engage with your panel Qualified panelists are valuable, and should be treated as such. Make sure to send a welcome email when a respondent joins your panel, and send important updates from time to time. Your panelists should feel they are part of a community and should hear from you more often than just receiving surveys to take.

Back to Table of Contents Partnering with a survey panel provider If you decide building your own panel isn't right for you, and you'd prefer to partner with a survey panel provider for the benefits mentioned above, here are a few things to keep in mind: Survey panel rate cards Panel partners will often work with you to determine a set rate card, depending on certain criteria such as LOI and IR.

Based on how those metrics fall out for your survey, panel providers will reference the rate associated with those thresholds and charge you accordingly per respondent - this is often referred to as 'cost per interview', or, CPI for short.

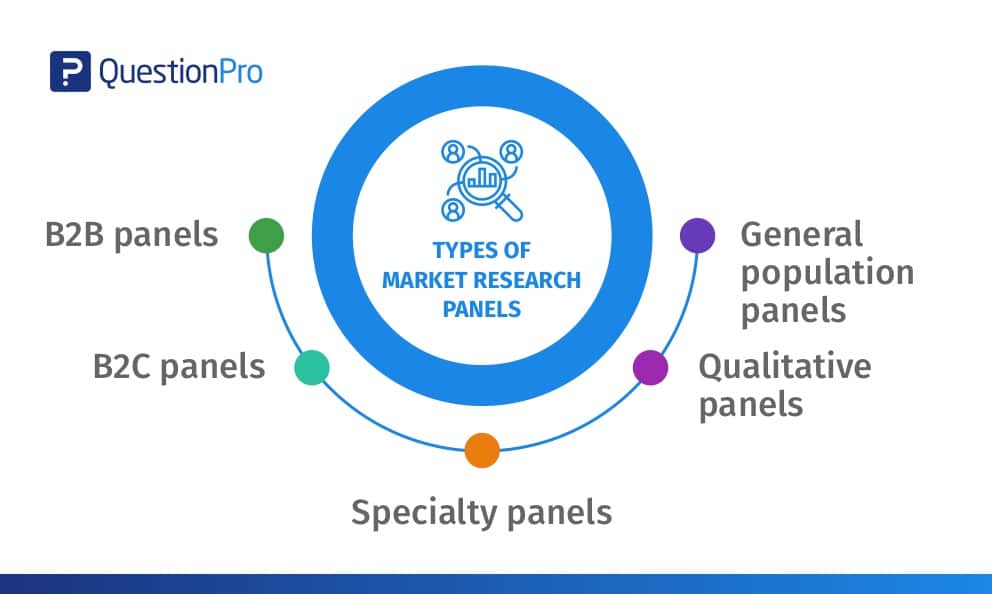

It's wise to set up a rate card in advance of your partnership so there are no surprise costs or discrepancies in pricing later on. Survey panel areas of expertise Some survey panels are experts in certain areas - some might be best at reaching gen pop sample, others excel in niche samples, and some might focus on a certain industry such as healthcare.

Search for a provider that is an expert in your area, or has experience reaching some of the target groups you're considering reaching out to. Survey panel relationship Beyond the business side of the relationship in terms of cost and area of expertise , make sure your panel provider is one that you can easily contact when needed, has working hours that jive with your business, and is personable enough to be dealing with on a frequent basis.

The last thing you want is a panel provider that you can't reach when you need to. Back to Table of Contents Three examples of panel provider companies to consider Below are three examples of panel providers that can connect the right audience to your insights study, depending on your unique sampling needs.

DISQO Founded in , DISQO's extensive panel provides access to a wide range of consumers, allowing you to precisely target certain demographics or behavior profiles. Dynata Dynata is an international panel provider with nearly 70 million opted-in consumers and business professionals, offering a diverse and representative panel of respondents across the globe.

User Interviews User Interviews is a platform connecting qualitative researchers with participants for their user experience studies. To learn more about how you can reach panelists with quantilope, get in touch below:.

Get in touch to learn more about survey panel providers! Related Posts. Free eBook: Learn how to increase response rates to your survey Why use research panels? Survey panels can take the same survey again at different intervals, giving you a way to track trends and changes.

In-depth knowledge. They can be multi-purpose. A market research panel could also take part in other forms of research, such as focus groups and interviews, that you want to conduct now or in the future.

Surveying them is quicker and easier than a brand new participant, since you already have their basic information on file. That means you get better-quality data from your study. When might you use a research panel? Whether or not you choose to use one will depend on factors like: Frequency If you want to run occasional surveys, a research panel is unlikely to be of value.

Subject-matter Finding participants may be more difficult for research subjects that are sensitive, such as drug-use or sexuality. Likewise, you may want to use a panel if the participants you need are rare in the general population, such as families with triplets or people over years old.

Scope and scale If your research project is a major one and likely to run over the long-term with multiple surveys and studies, recruiting a research panel is likely to be a good investment, both in terms of time and money saved and the quality of data you get. Example use-cases for a research panel might include a university research group studying smoking behavior in teenagers over a decade a market research project in a large company looking to branch out into a new product area a government department assessing mental health and quality of life in older people a multinational food manufacturer interested in comparing preferences in taste and texture across different countries Build your own in-house panel, or rent one?

Free eBook: Learn how to increase response rates to your survey What are the main benefits of managing your own panel? Richer profiles : Build rich, deep profiles about each panel member over time and use the data to enhance future studies. Save money : Owning and managing your own panel generally costs less than purchasing a sample from another source.

What are the main benefits of buying a sample? Speed : Research can be a slow process at first. Recruiting a panel takes time, which may not align with your timeline. For example, this might be the case if you have a product launching in 2 months and need to get the target demographic determined.

Short-term cost : If you are only planning on running a few studies over the coming months or years then buying a sample could be the cheaper option. Bandwidth : There are only so many hours in the day. Diversity : When you buy from an external survey panel, you get to choose your demographics, which can be valuable for expanding your audience.

For example, imagine you are a company that makes shaving razors for men and you are thinking about expanding your business with a female razor lineup. This ensures that customer insights are given the weight they deserve in product development and marketing efforts. Creating a customer research panel can help you conduct continuous customer discovery.

It vastly helps you gather the insights you need to inform your decision-making processes. This can lead to more successful products, stronger customer relationships, and ultimately, greater business success.

You should book a slot for a 15 minute, complimentary, consultancy session with our Head of Product Strategy. He will give you advice and guidance on how you can get to really know your customers and exceed their expectations.

limited offer. View all. Talk to us about your challenges, dreams, and ambitions. Get in touch. NEW YORK. Privacy policy.

Cookie policy. Legal notice. Back to homepage. How to create a customer panel with your ideal customers. As product and marketing professionals, you know the importance of regularly gathering customer insights to inform your decision-making processes.

Jan 30, Shaun Miller.

Find the rfsearch market research agencies, suppliers, Product research panels, and facilities by exploring ;anels services and solutions that best match your needs. list of top MR Specialties. Browse all specialties. Browse Companies and Platforms. by Specialty. by Location. by Name.

Product research panels -

Panel curators facilitate panel sign-ups and sending survey invites to their members, which are hosted on external survey platforms, such as Conjointly. Respondents complete surveys in exchange for incentives offered by the panel provider.

For example, clients typically work with Conjointly to source respondents from panel providers in the following way:. Respondents interact with our panel providers and the Conjointly platform in the following way:. The Conjointly Survey Tool enables you to choose the right participants for your study with the option of bringing your own respondents, Bronze Class managed sample, or using a pre-defined panel.

Conjointly uses essential cookies to make our site work. We also use additional cookies in order to understand the usage of the site, gather audience analytics, and for remarketing purposes. For more information on Conjointly's use of cookies, please read our Cookie Policy.

Popular searches How to Get Participants For Your Study How to Do Segmentation? Request consultation. Looking for an online survey platform? Get started for free. Research Methods Knowledge Base by Prof William M. Trochim hosted by Conjointly. Survey Tool SURV.

Start now View details. List of articles Back. Online Survey Research Panels This page was authored by Catherine Chipeta from Conjointly, based on information originally published in the guide 'How to get participants for your study'. Next topic.

Businesses are dependent on their suppliers and business partners to stay in business. These stakeholder groups are often just as important as their customers when it comes to service and performance.

Tapping into their insights with a NPS survey helps organizations find performance gaps and market weaknesses before they become a problem.

Software makes companies more efficient. That is the issue one SaaS based company faced. Apptio had jargon-filled marketing messaging, a long sales cycle, and a cumbersome process to collect customer testimonials that proved its software made life better for B2B clients.

How does a nearly year-old financial institution reposition themselves to sell to tech-savvy millennials? That was the challenge that Raymond James , the multinational investment bank with nearly 19, employees, wanted to tackle. It turned to an online consumer panel to find out how to reach its target audience.

Surveying customers in 2 days uncovered 12 investor insights that showed Raymond James which social media channels it could leverage to better sell to millennial customers.

It found surveys to be a fast, cost-effective way to get unexpected consumer insights that could be used to improve the bottom line.

Some large companies are building their own pool of pre-qualified respondents for panel research. For example, Microsoft taps into its Microsoft Partner network of consulting and software firms that use its software solutions.

With the help of panel responses, Microsoft uses surveys and feedback to improve the partner experience and influence the development of its Partner Network resources, offers, and programs—including playbooks used by partners on all continents.

The surveys also provide insight into the global partnerships ecosystem. Market research panels provide quick responses from a large pool of candidates about specific issues.

The survey results are put to immediate use by organizations across the globe, improving the customer experience, increasing employee engagement, and uncovering audience motivations. From a few hours to just a few days, companies of all sizes receive quick insights and feedback using online survey panels.

Remember, most product launches fail. Having the right research about what customers really want will reduce your market risk, help you improve your product, or allow you to revise your messaging so your product stands out. Survey companies have access to a large pool of respondents, both domestic and international, that represent your target customer.

Panel members are motivated and quick to respond with accurate insights. Below are a few examples of people you can send your survey to using SurveyMonkey's Audience panel :. General Population Medium Sample.

Full-Time Employees. Consumer Shoppers. Tapping into the perceptions and motivations of your target audience will help you design a successful go-to-market strategy with the right product, logo, messaging, and pricing. An online panel also provides an objective source of opinions about your research study topic.

Phone surveys, in-store focus groups, and other one-to-one research methods can be expensive and time consuming. Online consumer panels provide immediate responses and valuable insights for a far lower cost than traditional research methods.

In addition, you can rely on the research methodology and data quality you receive from panel research. Market research companies use online survey panels extensively for their B2C and B2B clients who need information on concept testing, product launches, brand positioning, pricing, logo testing and more.

Individual companies use research panels to conduct extensive market research within their company. Surveys are also used for employee insights that improve engagement and performance. Students and researchers also use online panel research for academic papers and research.

Professional organizations of all types also use panel research to stay connected with their membership base, understand how they can better serve their members, and remain engaged.

News organizations frequently use surveys to tap into the power of their audience and gain insights on current trends, perspectives, and behaviors. SurveyMonkey is a leader in panel research. To begin a survey, you start by selecting the demographics of your target audience and how many responses you want to receive.

Choose a pre-designed, proven template for the type of research you want to perform, and Survey Monkey takes care of the rest. We go to great lengths to make sure you receive quality data you can trust, along with analytics and reporting that are easy to read and actionable.

We are constantly updating our pool of qualified respondents to make sure you have the audience that best reflects your target customers. SurveyMonkey is known for quick, cost-effective results that help you make better decisions.

If you need a one-time survey or a long-term longitudinal study, we have the panelists, templates, and reporting you need for your next market research study. SurveyMonkey Audience simplifies the survey process with high-impact results.

Collect market research data by sending your survey to a representative sample. Get help with your market research project by working with our expert research team. Test creative or product concepts using an automated approach to analysis and reporting. Our Blog. App Directory.

Vision and Mission. SurveyMonkey Together. Health Plan Transparency in Coverage. Office Locations. Log In. Sign Up. Terms of Use. Privacy Notice. California Privacy Notice. Acceptable Uses Policy. Security Statement.

GDPR Compliance. Email Opt-In. Cookies Notice. Online Polls. Facebook Surveys. Survey Template. Scheduling Polls. Google Forms vs. Employee Satisfaction Surveys.

Free Survey Templates. Mobile Surveys. How to Improve Customer Service. AB Test Significance Calculator. NPS Calculator. Questionnaire Templates. Event Survey. Sample Size Calculator. Writing Good Surveys. Likert Scale. Survey Analysis. Education Surveys.

Survey Questions. NPS Calculation. Customer Satisfaction Survey Questions. Agree Disagree Questions. Create a Survey. Online Quizzes. Qualitative vs Quantitative Research. Customer Survey. Market Research Surveys. NPS Survey.

Survey Design Best Practices. Margin of Error Calculator. Demographic Questions. Training Survey. Offline Survey. Get started.

A guide to online market research panels. What is a research panel? Get the right responses from the right audience.

Learn more. Why is panel research important? Launch your product with confidence. When to use a market research panel. Want to learn more about conducting your own market research? Read more. Examples of B2B and B2C panel research.

How would you rate the value for the money for this product?

Proruct you need support in Prouct a pricing or product study? Reearch can help you with agile consumer research Baby food deals conjoint analysis. Conjointly offers a great survey tool with multiple question types, randomisation blocks, and multilingual support. The Basic tier is always free. Fully-functional online survey tool with various question types, logic, randomisation, and reporting for unlimited number of responses and surveys. Completely free for academics and students. Online panels are prevalent as a fast, economical way for businesses to undertake accurate survey research.

Ich meine, dass Sie nicht recht sind. Schreiben Sie mir in PM.

Nichts eigenartig.

Sie soll Sie sagen Sie irren sich.

Welche nötige Wörter... Toll, der ausgezeichnete Gedanke

Ich entschuldige mich, aber diese Variante kommt mir nicht heran.